Berlin real estate market

Opportunities for real estate investors

Over recent years, the Berlin real estate market has achieved significant momentum. Foreign buyers have discovered the value of Berlin property investments and are providing an additional boost to purchase rates. The appeal of the German capital is greater than ever. Following a period of relatively stagnant growth – the population will exceed 3.7 million inhabitants in 2021 and the Berlin Senate predicts an increase to over 4 million residents by 2025 to 2030.

Despite the European Union debt crisis, the robust German economy makes its major cities a safe spot for real estate investors.

A sustainable relationship between supply and demand remains, given that Berlin property sales remained at an extremely low level for a long time, with nearly no construction of new buildings over the past 15 years. This results in further price and rent increases to be expected.

Price trend Berlin

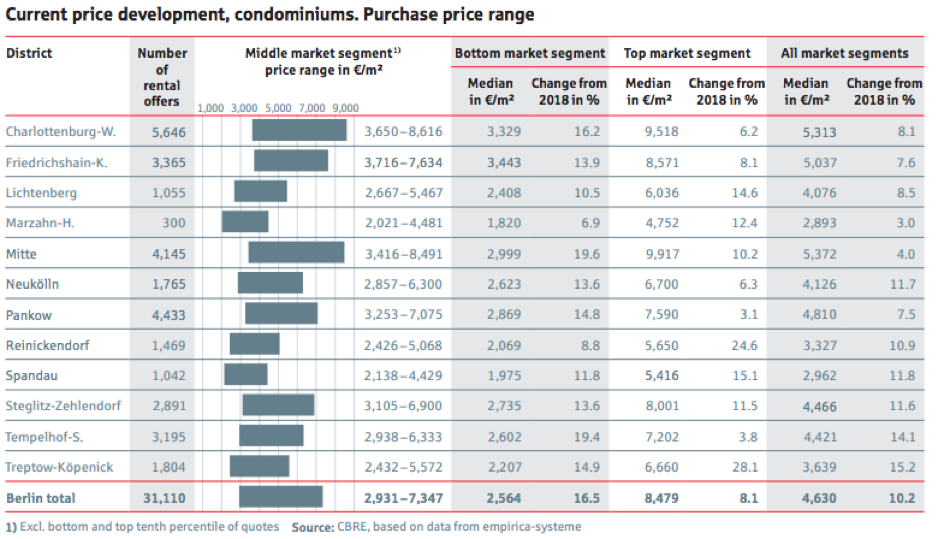

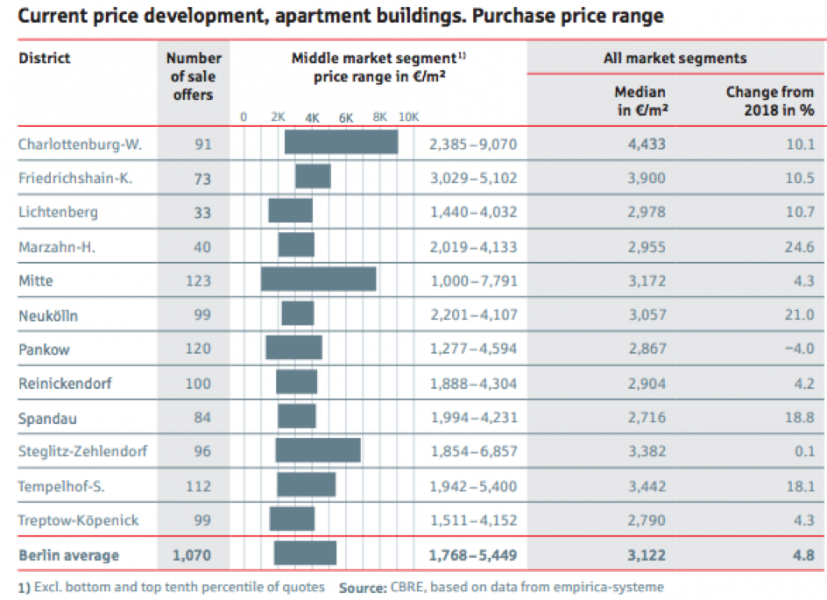

Overview of the price segments according location

Despite the balance between supply and demand of Berlin property, it is becoming noticeably more difficult to find well-priced properties in good locations. The luxury segment offers the least number of available properties – with top properties frequently sold in the planning stages of construction or refurbishment.

- Purchase prices of properties in the lower segment of the market and in Berlin’s periphery are available from €3,000 to €4,500 per square meter.

- For buy-to-let properties in affluent locations, prices can range from €4,500-6,000 per square meter. In upmarket locations or in the direct centre prices go up to €7,000 per square meter. Vacant property or new developments are likely to be 30% to 50% more expensive in these locations.

- Less expensive properties are in the market closer to the periphery, such as Lichtenberg (€3,800), Reinickendorf (€3,500) or Marzahn-Hellersdorf (€2,500).

- Apartments or residential buildings in peripheral locations, including those needing renovation, fall into a price range between 25 to 30 times their annual net rent, giving a return of about 3-3,5%. In prime locations, sales prices are roughly 28- 35 times the annual rent, returning about 1-2,5%.

Berlin rental market

Moderate rent increase to be expected

Higher purchase prices impact rent levels in the medium term. Berlin residential rents have risen continuously since 2012, due to an imbalance between supply and demand and a high demand for housing. Due to interventions by the Berlin Senate in the rental market 2020/21, rents are expected to stagnate for the time being.

Recent figures provided by the Berlin Tenants’ Association indicate, the number of households has increased by 134,800 in the past decade, while the number of additional flats has just risen by 33,366. Berliners currently spend about a quarter of their income on rent. A map showing the development of living costs, created by the German Real Estate Association, shows this is similar to the development of residential rents paid in Munich. However, Munich residents pay € 16.00 per square meter. This is almost twice the rents paid in Berlin.